Thales awarded contract for Dreadnought submarine masts

Thales has been awarded a GBP169 million (USD220 million) contract to equip the UK Royal Navy's (RN's) Dreadnought nuclear-powered ballistic missile submarines (SSBNs) with a new Integrated Combat System Mast solution.

Announcing the award on 13 July Thales said the new mast would provide the submarines' above-water situational awareness by – for the first time – combining advanced visual sensors, electronic warfare (EW), and communications capabilities into a single package. The scope of supply includes two masts for each Dreadnought boat.

The company has already been contracted to supply its Sonar 2076 integrated suite for the Dreadnought submarines.

The latest award builds on a tradition dating back to 1917, whereby Thales has equipped every RN submarine in service with a periscope or optronics mast manufactured at its site in Glasgow, on the Clyde.

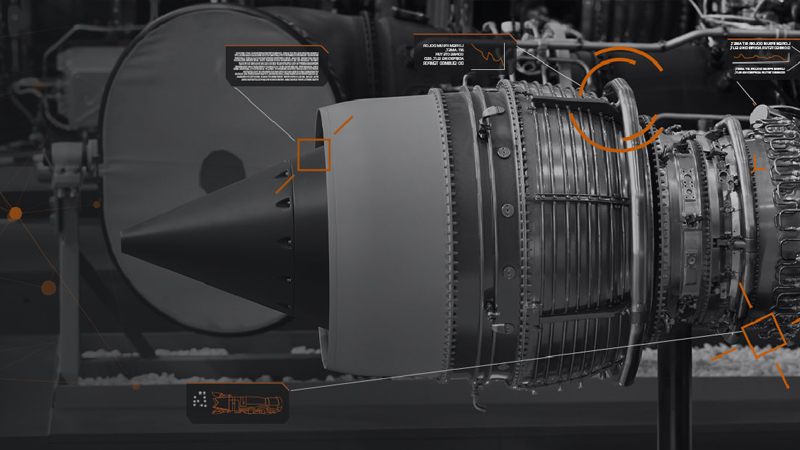

The Integrated Combat System Mast is an evolution of the company's first-generation system, known as the CM010, which equips the UK's Astute-class nuclear attack submarines (SSNs) and Japan's Soryu-class diesel-electric submarines (SSKs).

Earlier in 2023 Thales completed the development of the baseline new-generation variant, known as the CM020, which features all the functionalities of the CM010 but in a smaller mast with a much lower profile, reduced signature, and more advanced sensors. According to Thales, the Integrated Combat System Mast for Dreadnought has taken this development a step further by increasing the power and the stealth of that mast capability through the addition of a next-generation digital radar electronic support measures (RESM) solution designed and manufactured at Thales' Crawley site.

Under the Dreadnought programme, BAE Systems is building four new SSBNs – with three units now in build – at its Barrow-in-Furness facility. They are intended to replace the RN's four Vanguard-class submarines from the late 2020s to early 2030s. Armed with the Trident II D5LE strategic weapon system, the Dreadnought SSBNs will maintain the UK's continuous at-sea deterrent into the 2060s.