- About

- Intara

- Capabilities

- Advisory

- Resources

- News

- Store

Janes - News page

- Home

- News

Ukraine conflict: Impact on military aircraft programmes managed by Ukraine in Asia

09 March 2022

by Alessandra Giovanzanti

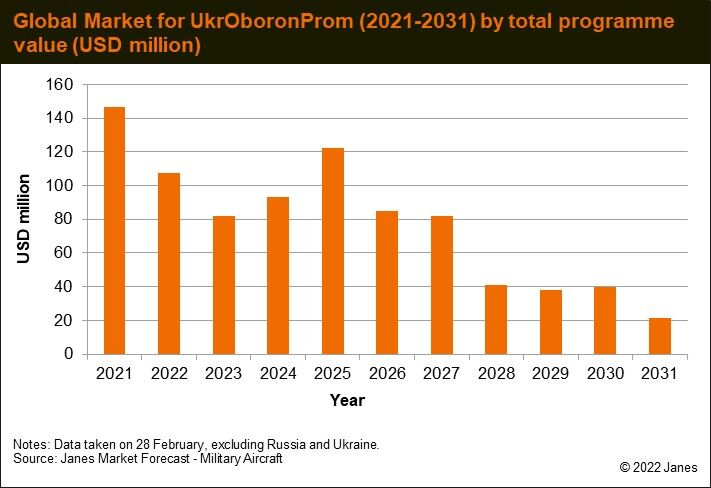

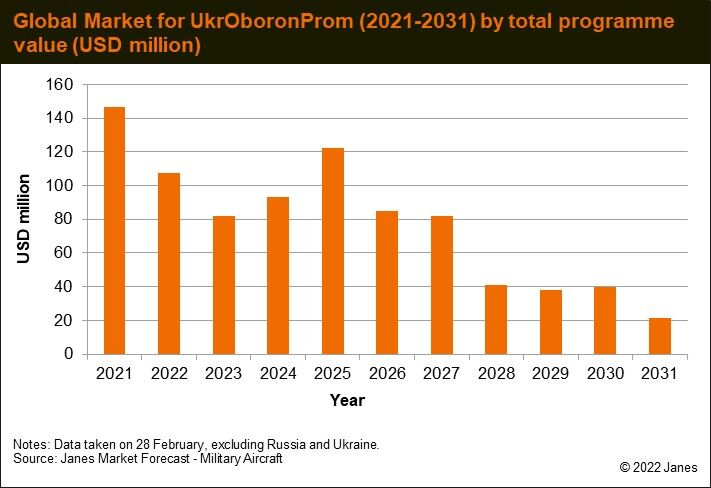

Janes Markets Forecast: Military aircraft data on the global market for UkrOboronProm during 2021–31 by the total programme value. (Janes)

Ukrainian Antonov legacy transport aircraft are widely in use with military operators around the world, while Motor Sich engines power a few legacy Russian military helicopters and fixed-wing aircraft, such as the old Aero Vodochody L-39 trainer/light attack aircraft and more modern Hongdu Aviation Industry Group Corporation (HAIC) L‐15 jet trainers.

State-owned defence conglomerate UkrOboronProm (UOP), of which Antonov is part, is also involved in a series of maintenance and upgrade programmes of Russian-made platforms operated by South Asian armed forces.

The conflict in Ukraine will likely affect the supply of parts and kits to sustain ageing Antonov aircraft, as well as of engines and upgrades to different aircraft types managed by UOP and its export entities, especially in Asia.

Ukraine's main airbases and industrial assets have been targeted since the beginning of the conflict. Antonov Airport in Hostomel, where the company is based, witnessed clashes between Russian and Ukrainian troops since day one. Meanwhile, Lviv State Aircraft Repair Plant, which has historically been servicing Kazakhstan MiG-27 and MiG-29 combat aircraft, as well as Azerbaijan, Bangladesh, and Sudan MiG-29s, was allegedly destroyed. The fate of several MiG-29 fighter aircraft of the Azerbaijan Air Forces that were receiving upgrades at the factory is unknown.

Janes Markets Forecast data for military aircraft programmes, compiled on 28 February, and excluding Russia and Ukraine, show that the market for UOP between 2021 and 2031, before the conflict, was estimated at around USD710 million.

This figure mostly includes support services for existing fleets of Antonov military aircraft and contracted maintenance, repair, and overhaul (MRO) activities for, among others, the Mi-17 fleet in service with the Bangladesh Air Force, performed in-country at a service centre opened in January 2018 by Ukrinmash, a UOP export company.

Comprised in this estimated market value are also the ongoing upgrades for the An-32 fleet of the Indian Air Force and the Ilyushin Il-78 transport/tanker fleet of the Pakistan Air Force (PAF).

Inventory of Antonov aircraft around the world

A significant number of Antonov legacy transport aircraft, manufactured during the Soviet era, are flown by several armed forces around the world. Janes Inventory data suggest that, excluding Russia and Ukraine, about 300 Antonov military aircraft are in service, including special mission variants. About 63% of these aircraft are in service with armed forces in Asia (including a number of An-2 aircraft that have been modified to kamikaze unmanned aerial vehicles in Azerbaijan).

Russia remains to be the largest operator of Antonov transport aircraft, with more than 300 aircraft ranging from An-2 and An-26 to the more recent An-140 and An-148. Since 2014, Russia has been looking for alternative sources to sustain Antonov aircraft and manufacture replacement platforms, as well as substitute existing Ukrainian engines that power a range of fixed-wing aircraft and military helicopters, including Mi and Ka medium-class helicopters, Yak-130 trainers, Be-200 amphibious aircraft, and An-124 and An-148 transport aircraft.

Besides Russia, the Antonov light to medium/heavy airlifters are widely used in Asia, with India operating more than 100 An-32 twin-turboprop tactical transport aircraft.

Most of these aircraft are more than 30 years old, with a few being upgraded, while the majority of others are in need of replacement or about to be retired. Janes assesses that the current crisis could accelerate replacement programmes and the retirement of such assets.

At present, there is no export order from military operators for the An-178, Antonov's only new-build twin-turbofan medium-lift military aircraft, while Antonov's attempts in the mid-late 2010s to establish partnerships to co-produce military airlifters, such as the An-132 with Saudi Arabia and then An-132D maritime patrol aircraft with Turkey, have also failed.

The most recent contract activity was the renewal in November 2021 for the NATO's Strategic Air Lift International Solution (SALIS) programme that provides outsized cargo airlift to nine NATO countries, with up to five An-124 aircraft contracted to be available within a few days of tasking. Other aircraft, including An-22, An-225, and Ilyushin IL-76 aircraft, can be mobilised as required under SALIS.

It is unclear how the conflict will affect Antonov aircraft's availability for the SALIS programme, although a subsidiary business, Antonov Logistics SALIS GmbH, has its base of operations at the Leipzig/Halle airport in Germany.

The 18-tonne-payload An-178 was originally set to replace the An-12 ‘Cub', the An-26 ‘Curl', and the An-32 ‘Cline' airlifters in service with the Ukrainian Air Force, but was also seen as a viable contender on the international fixed-wing medium-lift market.

Although past interest has been reported by the armed forces of Azerbaijan and Peru, this has not led to acquisitions, and only civil or law enforcement operators have ordered the An-178 so far. Nonetheless, the conflict in Ukraine also puts these existing An-178 orders at risk, such as the one for the National Police of Peru. Janes understands the Peruvian government would have paid for the aircraft only upon its completion and that the aircraft were in their final assembly stage at Antonov's facilities in Kyiv during the attack by Russian forces.

Military aircraft programmes in Asia at risk

The Ukrainian industry is also working on the modernisation of different aircraft types in service in Asia.

The Indian Air Force is upgrading its fleet of about 104 An-32 tactical transport aircraft to the An-32 RE standard to extend their service life and provide new avionics, a modern cockpit layout, and work for the reduction of noise and vibration levels

The programme started in 2009 but stalled in 2014 after the first 35–40 units were upgraded in Ukraine, as Moscow refused to transfer key equipment to Kyiv in the aftermath of the Crimea conflict. The programme resumed in early 2019, as Ukraine developed alternatives to the Russian-made systems for the aircraft. The remaining platforms are scheduled to be upgraded in India in a phased manner depending upon the supply of modification kits by Ukraine.

This programme has suffered from additional delays in its local assembly phase, and its completion is projected at around 2025. The conflict could further affect this programme, as the status of the shipments from Ukraine is unknown.

After upgrading a first aircraft in Russia, Pakistan turned to UOP for the upgrade of a second Il-78 transport/tanker aircraft. The contract, valued at USD30 million in June 2020, also included an option to upgrade the remaining two aircraft in service with the PAF.

Although the first aircraft upgraded in Ukraine was returned to the PAF in early 2022, the option for the remaining two aircraft may not be exercised at this stage, and Pakistan may look for alternative sources or decide not to upgrade the last two Il-78s and proceed with a replacement programme instead.

Motor Sich engines

Ukraine is also a supplier of engines for military aircraft. Until 2014, Motor Sich had a virtual monopoly on the supply of certain military helicopter engines to Russian Helicopters, and also currently provides the AI‐222‐25F engine that powers the HAIC L‐15 jet trainer.

Looking at Ukraine as a supplier of engines to export customers and leveraging Janes Markets Forecast data, Janes has identified additional military aircraft programmes that could be affected by the Ukrainian conflict.

The Chinese L-15/JL-10 advanced trainer aircraft is powered by Ivchenko-Progress AI-222K-25F turbofan engines, and is in service with the People's Liberation Army Air Force (PLAAF), the People's Liberation Army Navy (PLAN), and the Zambian Air Force, with Chinese operators still receiving the aircraft.

It is unclear how the conflict will affect the recently signed deal between the United Arab Emirates Ministry of Defence and China National Aero-Technology Import & Export Corporation (CATIC) for the acquisition of 12 L-15 aircraft for the UAE Air Force and Air Defence (AFAD), with options for a further 36 to follow.

However, Janes understands that China co-produces the engines (also known as WS15 ‘Emei') and can autonomously supply these engines to export customers. Moreover, China is known to be testing a locally developed engine for its JL-10 trainer aircraft, although initially this would likely be in use just for domestic aircraft.

HAIC and Pakistan Aeronautical Complex (PAC) K-8 (Karakorum-8) single-engine basic trainer/light attack aircraft can be powered by Ivchenko-Progress AI-25TLK turbofan engines or similarly rated Chinese-made WS11 engines. A few aircraft, such as the K-8E in service with the Egyptian Air Force, use Honeywell TFE731 engines, provided the US authorises the export of these engines.

According to Janes data, the Bangladesh Air Force (BAF) operates K-8W aircraft powered by Ukrainian engines. A first batch of nine aircraft was delivered in 2014, and in June 2018 it was reported that the BAF has signed an agreement with China for an additional 23 K-8W trainers, of which several will be used for an aerial display team. Of the second order, six or seven aircraft were delivered in late 2020. It is unclear how the delivery of the remaining aircraft will be affected by the current crisis.

Ukrainian engines also power, among others, Russian Mi-26 heavy transport helicopters and legacy Aero Vodochody L-39 lead-in fighter trainers that are primarily in service in Asia and Africa.

In 2016 Russia started developing the PD-12V engine, a variant of the Aviadvigatel PD-14 turbofan engine to power the Mi-26T2 variant, which uses two Ivchenko-Progress modernised D-136-2 engines. Initial flight tests of the re-engined heavy helicopter are scheduled to start in 2023, with approval for serial production expected in 2025. However, this timeline could suffer from additional delays in light of current events. Besides Russian forces, the Mi-26T2 helicopter is in service in Algeria.

Turkish ATAK programmes

A shortage of Motor Sich engines could also affect progress in the development of the Turkish Aerospace Industries (TUSAŞ) T929 ATAK 2 11-ton heavy attack helicopter and the pending export of T-129 ATAK attack helicopters to Pakistan.

On 29 June 2021 TUSAŞ announced that it had signed a contract with Motor Sich for the supply of 14 TV3-117 2,500 hp turboshaft engines for the ATAK 2 programme, with the first two scheduled for delivery in 2022 and the remainder until 2025. The first aircraft would conduct its maiden flight in 2023.

The delivery of the first two engines is scheduled by September 2022. At this stage, it is unclear how this timeline will be affected by the conflict.

The selection of Ukrainian engines also sought to overcome US sanctions on the sale of CTS800-4A engines built by Honeywell and Rolls-Royce joint-venture Light Helicopter Turbine Engine Company (LHTEC) to third countries without an export permission. Indeed, LHTEC engines power the T129 ATAK procured under licence from Leonardo and on which the ATAK 2 is based.

Delays in obtaining export licences for the LHTEC engines have so far hindered the sale of 30 T129s to Pakistan, which was officially announced in 2018 for USD1.5 billion, and prompted the latter to look for other options, including Chinese Changhe Aircraft Industries Corporation (CAIC) Z-10ME attack helicopter, among others.

However, in an interview with a Pakistani private TV channel on 18 February, TUSAŞ CEO Temel Kotil said that the sale of the T-129s to Pakistan had not been cancelled. Instead, TUSAŞ will deliver the 30 licenced-produced attack helicopters equipped with engines sourced from Ukraine, Kotil added.

It is unclear what alternative solution Turkey may pitch to Pakistan to replace the Ukrainian engines, if no longer available, and achieve the T129 sale.

Ukrainian Antonov legacy transport aircraft are widely in use with military operators around the wor...

Ukraine conflict: Impact on military aircraft programmes managed by Ukraine in Asia

09 March 2022

by Alessandra Giovanzanti

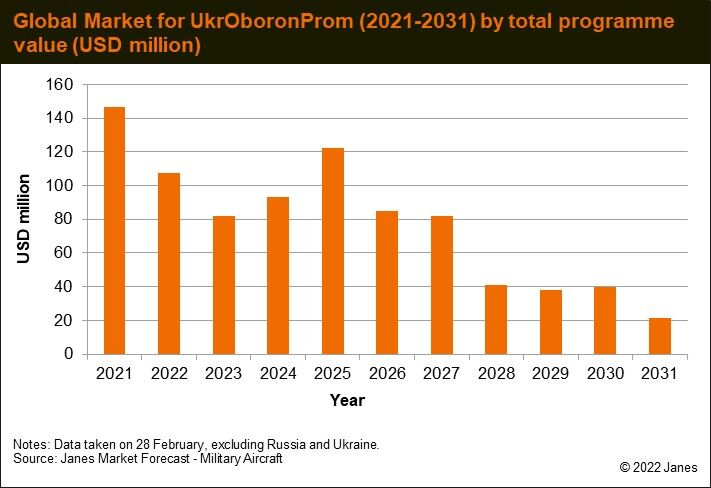

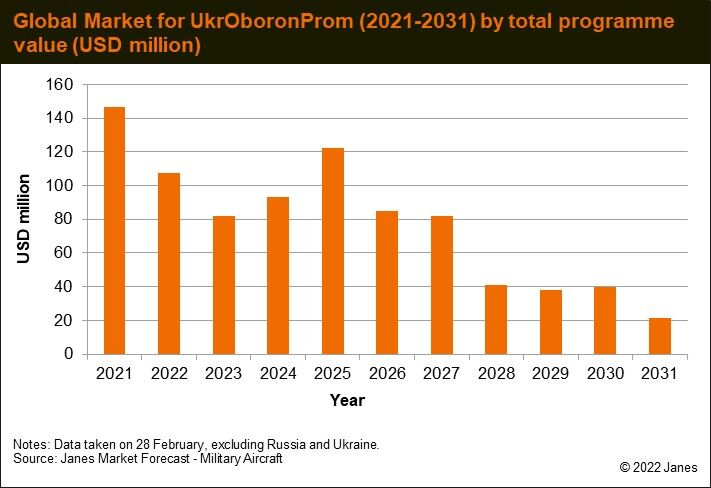

Janes Markets Forecast: Military aircraft data on the global market for UkrOboronProm during 2021–31 by the total programme value. (Janes)

Ukrainian Antonov legacy transport aircraft are widely in use with military operators around the world, while Motor Sich engines power a few legacy Russian military helicopters and fixed-wing aircraft, such as the old Aero Vodochody L-39 trainer/light attack aircraft and more modern Hongdu Aviation Industry Group Corporation (HAIC) L‐15 jet trainers.

State-owned defence conglomerate UkrOboronProm (UOP), of which Antonov is part, is also involved in a series of maintenance and upgrade programmes of Russian-made platforms operated by South Asian armed forces.

The conflict in Ukraine will likely affect the supply of parts and kits to sustain ageing Antonov aircraft, as well as of engines and upgrades to different aircraft types managed by UOP and its export entities, especially in Asia.

Ukraine's main airbases and industrial assets have been targeted since the beginning of the conflict. Antonov Airport in Hostomel, where the company is based, witnessed clashes between Russian and Ukrainian troops since day one. Meanwhile, Lviv State Aircraft Repair Plant, which has historically been servicing Kazakhstan MiG-27 and MiG-29 combat aircraft, as well as Azerbaijan, Bangladesh, and Sudan MiG-29s, was allegedly destroyed. The fate of several MiG-29 fighter aircraft of the Azerbaijan Air Forces that were receiving upgrades at the factory is unknown.

Janes Markets Forecast data for military aircraft programmes, compiled on 28 February, and excluding Russia and Ukraine, show that the market for UOP between 2021 and 2031, before the conflict, was estimated at around USD710 million.

This figure mostly includes support services for existing fleets of Antonov military aircraft and contracted maintenance, repair, and overhaul (MRO) activities for, among others, the Mi-17 fleet in service with the Bangladesh Air Force, performed in-country at a service centre opened in January 2018 by Ukrinmash, a UOP export company.

Comprised in this estimated market value are also the ongoing upgrades for the An-32 fleet of the Indian Air Force and the Ilyushin Il-78 transport/tanker fleet of the Pakistan Air Force (PAF).

Inventory of Antonov aircraft around the world

A significant number of Antonov legacy transport aircraft, manufactured during the Soviet era, are flown by several armed forces around the world. Janes Inventory data suggest that, excluding Russia and Ukraine, about 300 Antonov military aircraft are in service, including special mission variants. About 63% of these aircraft are in service with armed forces in Asia (including a number of An-2 aircraft that have been modified to kamikaze unmanned aerial vehicles in Azerbaijan).

Russia remains to be the largest operator of Antonov transport aircraft, with more than 300 aircraft ranging from An-2 and An-26 to the more recent An-140 and An-148. Since 2014, Russia has been looking for alternative sources to sustain Antonov aircraft and manufacture replacement platforms, as well as substitute existing Ukrainian engines that power a range of fixed-wing aircraft and military helicopters, including Mi and Ka medium-class helicopters, Yak-130 trainers, Be-200 amphibious aircraft, and An-124 and An-148 transport aircraft.

Besides Russia, the Antonov light to medium/heavy airlifters are widely used in Asia, with India operating more than 100 An-32 twin-turboprop tactical transport aircraft.

Most of these aircraft are more than 30 years old, with a few being upgraded, while the majority of others are in need of replacement or about to be retired. Janes assesses that the current crisis could accelerate replacement programmes and the retirement of such assets.

At present, there is no export order from military operators for the An-178, Antonov's only new-build twin-turbofan medium-lift military aircraft, while Antonov's attempts in the mid-late 2010s to establish partnerships to co-produce military airlifters, such as the An-132 with Saudi Arabia and then An-132D maritime patrol aircraft with Turkey, have also failed.

The most recent contract activity was the renewal in November 2021 for the NATO's Strategic Air Lift International Solution (SALIS) programme that provides outsized cargo airlift to nine NATO countries, with up to five An-124 aircraft contracted to be available within a few days of tasking. Other aircraft, including An-22, An-225, and Ilyushin IL-76 aircraft, can be mobilised as required under SALIS.

It is unclear how the conflict will affect Antonov aircraft's availability for the SALIS programme, although a subsidiary business, Antonov Logistics SALIS GmbH, has its base of operations at the Leipzig/Halle airport in Germany.

The 18-tonne-payload An-178 was originally set to replace the An-12 ‘Cub', the An-26 ‘Curl', and the An-32 ‘Cline' airlifters in service with the Ukrainian Air Force, but was also seen as a viable contender on the international fixed-wing medium-lift market.

Although past interest has been reported by the armed forces of Azerbaijan and Peru, this has not led to acquisitions, and only civil or law enforcement operators have ordered the An-178 so far. Nonetheless, the conflict in Ukraine also puts these existing An-178 orders at risk, such as the one for the National Police of Peru. Janes understands the Peruvian government would have paid for the aircraft only upon its completion and that the aircraft were in their final assembly stage at Antonov's facilities in Kyiv during the attack by Russian forces.

Military aircraft programmes in Asia at risk

The Ukrainian industry is also working on the modernisation of different aircraft types in service in Asia.

The Indian Air Force is upgrading its fleet of about 104 An-32 tactical transport aircraft to the An-32 RE standard to extend their service life and provide new avionics, a modern cockpit layout, and work for the reduction of noise and vibration levels

The programme started in 2009 but stalled in 2014 after the first 35–40 units were upgraded in Ukraine, as Moscow refused to transfer key equipment to Kyiv in the aftermath of the Crimea conflict. The programme resumed in early 2019, as Ukraine developed alternatives to the Russian-made systems for the aircraft. The remaining platforms are scheduled to be upgraded in India in a phased manner depending upon the supply of modification kits by Ukraine.

This programme has suffered from additional delays in its local assembly phase, and its completion is projected at around 2025. The conflict could further affect this programme, as the status of the shipments from Ukraine is unknown.

After upgrading a first aircraft in Russia, Pakistan turned to UOP for the upgrade of a second Il-78 transport/tanker aircraft. The contract, valued at USD30 million in June 2020, also included an option to upgrade the remaining two aircraft in service with the PAF.

Although the first aircraft upgraded in Ukraine was returned to the PAF in early 2022, the option for the remaining two aircraft may not be exercised at this stage, and Pakistan may look for alternative sources or decide not to upgrade the last two Il-78s and proceed with a replacement programme instead.

Motor Sich engines

Ukraine is also a supplier of engines for military aircraft. Until 2014, Motor Sich had a virtual monopoly on the supply of certain military helicopter engines to Russian Helicopters, and also currently provides the AI‐222‐25F engine that powers the HAIC L‐15 jet trainer.

Looking at Ukraine as a supplier of engines to export customers and leveraging Janes Markets Forecast data, Janes has identified additional military aircraft programmes that could be affected by the Ukrainian conflict.

The Chinese L-15/JL-10 advanced trainer aircraft is powered by Ivchenko-Progress AI-222K-25F turbofan engines, and is in service with the People's Liberation Army Air Force (PLAAF), the People's Liberation Army Navy (PLAN), and the Zambian Air Force, with Chinese operators still receiving the aircraft.

It is unclear how the conflict will affect the recently signed deal between the United Arab Emirates Ministry of Defence and China National Aero-Technology Import & Export Corporation (CATIC) for the acquisition of 12 L-15 aircraft for the UAE Air Force and Air Defence (AFAD), with options for a further 36 to follow.

However, Janes understands that China co-produces the engines (also known as WS15 ‘Emei') and can autonomously supply these engines to export customers. Moreover, China is known to be testing a locally developed engine for its JL-10 trainer aircraft, although initially this would likely be in use just for domestic aircraft.

HAIC and Pakistan Aeronautical Complex (PAC) K-8 (Karakorum-8) single-engine basic trainer/light attack aircraft can be powered by Ivchenko-Progress AI-25TLK turbofan engines or similarly rated Chinese-made WS11 engines. A few aircraft, such as the K-8E in service with the Egyptian Air Force, use Honeywell TFE731 engines, provided the US authorises the export of these engines.

According to Janes data, the Bangladesh Air Force (BAF) operates K-8W aircraft powered by Ukrainian engines. A first batch of nine aircraft was delivered in 2014, and in June 2018 it was reported that the BAF has signed an agreement with China for an additional 23 K-8W trainers, of which several will be used for an aerial display team. Of the second order, six or seven aircraft were delivered in late 2020. It is unclear how the delivery of the remaining aircraft will be affected by the current crisis.

Ukrainian engines also power, among others, Russian Mi-26 heavy transport helicopters and legacy Aero Vodochody L-39 lead-in fighter trainers that are primarily in service in Asia and Africa.

In 2016 Russia started developing the PD-12V engine, a variant of the Aviadvigatel PD-14 turbofan engine to power the Mi-26T2 variant, which uses two Ivchenko-Progress modernised D-136-2 engines. Initial flight tests of the re-engined heavy helicopter are scheduled to start in 2023, with approval for serial production expected in 2025. However, this timeline could suffer from additional delays in light of current events. Besides Russian forces, the Mi-26T2 helicopter is in service in Algeria.

Turkish ATAK programmes

A shortage of Motor Sich engines could also affect progress in the development of the Turkish Aerospace Industries (TUSAŞ) T929 ATAK 2 11-ton heavy attack helicopter and the pending export of T-129 ATAK attack helicopters to Pakistan.

On 29 June 2021 TUSAŞ announced that it had signed a contract with Motor Sich for the supply of 14 TV3-117 2,500 hp turboshaft engines for the ATAK 2 programme, with the first two scheduled for delivery in 2022 and the remainder until 2025. The first aircraft would conduct its maiden flight in 2023.

The delivery of the first two engines is scheduled by September 2022. At this stage, it is unclear how this timeline will be affected by the conflict.

The selection of Ukrainian engines also sought to overcome US sanctions on the sale of CTS800-4A engines built by Honeywell and Rolls-Royce joint-venture Light Helicopter Turbine Engine Company (LHTEC) to third countries without an export permission. Indeed, LHTEC engines power the T129 ATAK procured under licence from Leonardo and on which the ATAK 2 is based.

Delays in obtaining export licences for the LHTEC engines have so far hindered the sale of 30 T129s to Pakistan, which was officially announced in 2018 for USD1.5 billion, and prompted the latter to look for other options, including Chinese Changhe Aircraft Industries Corporation (CAIC) Z-10ME attack helicopter, among others.

However, in an interview with a Pakistani private TV channel on 18 February, TUSAŞ CEO Temel Kotil said that the sale of the T-129s to Pakistan had not been cancelled. Instead, TUSAŞ will deliver the 30 licenced-produced attack helicopters equipped with engines sourced from Ukraine, Kotil added.

It is unclear what alternative solution Turkey may pitch to Pakistan to replace the Ukrainian engines, if no longer available, and achieve the T129 sale.

Ukrainian Antonov legacy transport aircraft are widely in use with military operators around the wor...

Ukraine conflict: Impact on military aircraft programmes managed by Ukraine in Asia

09 March 2022

by Alessandra Giovanzanti

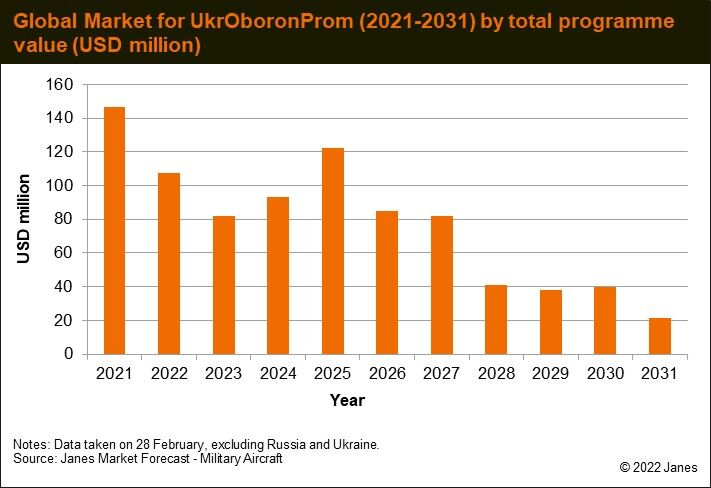

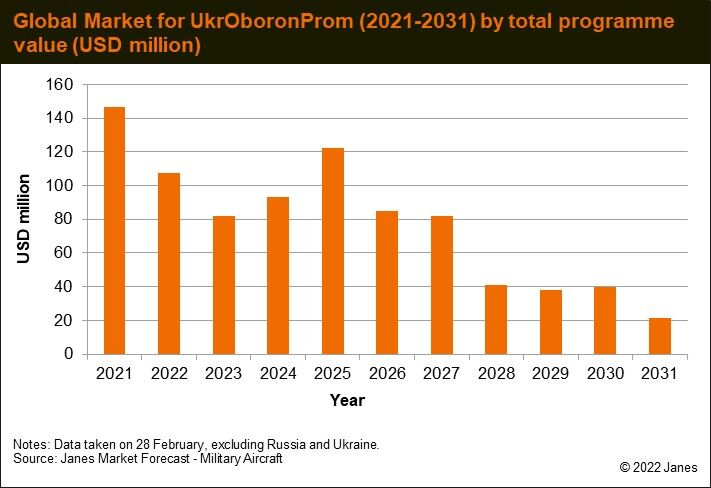

Janes Markets Forecast: Military aircraft data on the global market for UkrOboronProm during 2021–31 by the total programme value. (Janes)

Ukrainian Antonov legacy transport aircraft are widely in use with military operators around the world, while Motor Sich engines power a few legacy Russian military helicopters and fixed-wing aircraft, such as the old Aero Vodochody L-39 trainer/light attack aircraft and more modern Hongdu Aviation Industry Group Corporation (HAIC) L‐15 jet trainers.

State-owned defence conglomerate UkrOboronProm (UOP), of which Antonov is part, is also involved in a series of maintenance and upgrade programmes of Russian-made platforms operated by South Asian armed forces.

The conflict in Ukraine will likely affect the supply of parts and kits to sustain ageing Antonov aircraft, as well as of engines and upgrades to different aircraft types managed by UOP and its export entities, especially in Asia.

Ukraine's main airbases and industrial assets have been targeted since the beginning of the conflict. Antonov Airport in Hostomel, where the company is based, witnessed clashes between Russian and Ukrainian troops since day one. Meanwhile, Lviv State Aircraft Repair Plant, which has historically been servicing Kazakhstan MiG-27 and MiG-29 combat aircraft, as well as Azerbaijan, Bangladesh, and Sudan MiG-29s, was allegedly destroyed. The fate of several MiG-29 fighter aircraft of the Azerbaijan Air Forces that were receiving upgrades at the factory is unknown.

Janes Markets Forecast data for military aircraft programmes, compiled on 28 February, and excluding Russia and Ukraine, show that the market for UOP between 2021 and 2031, before the conflict, was estimated at around USD710 million.

This figure mostly includes support services for existing fleets of Antonov military aircraft and contracted maintenance, repair, and overhaul (MRO) activities for, among others, the Mi-17 fleet in service with the Bangladesh Air Force, performed in-country at a service centre opened in January 2018 by Ukrinmash, a UOP export company.

Comprised in this estimated market value are also the ongoing upgrades for the An-32 fleet of the Indian Air Force and the Ilyushin Il-78 transport/tanker fleet of the Pakistan Air Force (PAF).

Inventory of Antonov aircraft around the world

A significant number of Antonov legacy transport aircraft, manufactured during the Soviet era, are flown by several armed forces around the world. Janes Inventory data suggest that, excluding Russia and Ukraine, about 300 Antonov military aircraft are in service, including special mission variants. About 63% of these aircraft are in service with armed forces in Asia (including a number of An-2 aircraft that have been modified to kamikaze unmanned aerial vehicles in Azerbaijan).

Russia remains to be the largest operator of Antonov transport aircraft, with more than 300 aircraft ranging from An-2 and An-26 to the more recent An-140 and An-148. Since 2014, Russia has been looking for alternative sources to sustain Antonov aircraft and manufacture replacement platforms, as well as substitute existing Ukrainian engines that power a range of fixed-wing aircraft and military helicopters, including Mi and Ka medium-class helicopters, Yak-130 trainers, Be-200 amphibious aircraft, and An-124 and An-148 transport aircraft.

Besides Russia, the Antonov light to medium/heavy airlifters are widely used in Asia, with India operating more than 100 An-32 twin-turboprop tactical transport aircraft.

Most of these aircraft are more than 30 years old, with a few being upgraded, while the majority of others are in need of replacement or about to be retired. Janes assesses that the current crisis could accelerate replacement programmes and the retirement of such assets.

At present, there is no export order from military operators for the An-178, Antonov's only new-build twin-turbofan medium-lift military aircraft, while Antonov's attempts in the mid-late 2010s to establish partnerships to co-produce military airlifters, such as the An-132 with Saudi Arabia and then An-132D maritime patrol aircraft with Turkey, have also failed.

The most recent contract activity was the renewal in November 2021 for the NATO's Strategic Air Lift International Solution (SALIS) programme that provides outsized cargo airlift to nine NATO countries, with up to five An-124 aircraft contracted to be available within a few days of tasking. Other aircraft, including An-22, An-225, and Ilyushin IL-76 aircraft, can be mobilised as required under SALIS.

It is unclear how the conflict will affect Antonov aircraft's availability for the SALIS programme, although a subsidiary business, Antonov Logistics SALIS GmbH, has its base of operations at the Leipzig/Halle airport in Germany.

The 18-tonne-payload An-178 was originally set to replace the An-12 ‘Cub', the An-26 ‘Curl', and the An-32 ‘Cline' airlifters in service with the Ukrainian Air Force, but was also seen as a viable contender on the international fixed-wing medium-lift market.

Although past interest has been reported by the armed forces of Azerbaijan and Peru, this has not led to acquisitions, and only civil or law enforcement operators have ordered the An-178 so far. Nonetheless, the conflict in Ukraine also puts these existing An-178 orders at risk, such as the one for the National Police of Peru. Janes understands the Peruvian government would have paid for the aircraft only upon its completion and that the aircraft were in their final assembly stage at Antonov's facilities in Kyiv during the attack by Russian forces.

Military aircraft programmes in Asia at risk

The Ukrainian industry is also working on the modernisation of different aircraft types in service in Asia.

The Indian Air Force is upgrading its fleet of about 104 An-32 tactical transport aircraft to the An-32 RE standard to extend their service life and provide new avionics, a modern cockpit layout, and work for the reduction of noise and vibration levels

The programme started in 2009 but stalled in 2014 after the first 35–40 units were upgraded in Ukraine, as Moscow refused to transfer key equipment to Kyiv in the aftermath of the Crimea conflict. The programme resumed in early 2019, as Ukraine developed alternatives to the Russian-made systems for the aircraft. The remaining platforms are scheduled to be upgraded in India in a phased manner depending upon the supply of modification kits by Ukraine.

This programme has suffered from additional delays in its local assembly phase, and its completion is projected at around 2025. The conflict could further affect this programme, as the status of the shipments from Ukraine is unknown.

After upgrading a first aircraft in Russia, Pakistan turned to UOP for the upgrade of a second Il-78 transport/tanker aircraft. The contract, valued at USD30 million in June 2020, also included an option to upgrade the remaining two aircraft in service with the PAF.

Although the first aircraft upgraded in Ukraine was returned to the PAF in early 2022, the option for the remaining two aircraft may not be exercised at this stage, and Pakistan may look for alternative sources or decide not to upgrade the last two Il-78s and proceed with a replacement programme instead.

Motor Sich engines

Ukraine is also a supplier of engines for military aircraft. Until 2014, Motor Sich had a virtual monopoly on the supply of certain military helicopter engines to Russian Helicopters, and also currently provides the AI‐222‐25F engine that powers the HAIC L‐15 jet trainer.

Looking at Ukraine as a supplier of engines to export customers and leveraging Janes Markets Forecast data, Janes has identified additional military aircraft programmes that could be affected by the Ukrainian conflict.

The Chinese L-15/JL-10 advanced trainer aircraft is powered by Ivchenko-Progress AI-222K-25F turbofan engines, and is in service with the People's Liberation Army Air Force (PLAAF), the People's Liberation Army Navy (PLAN), and the Zambian Air Force, with Chinese operators still receiving the aircraft.

It is unclear how the conflict will affect the recently signed deal between the United Arab Emirates Ministry of Defence and China National Aero-Technology Import & Export Corporation (CATIC) for the acquisition of 12 L-15 aircraft for the UAE Air Force and Air Defence (AFAD), with options for a further 36 to follow.

However, Janes understands that China co-produces the engines (also known as WS15 ‘Emei') and can autonomously supply these engines to export customers. Moreover, China is known to be testing a locally developed engine for its JL-10 trainer aircraft, although initially this would likely be in use just for domestic aircraft.

HAIC and Pakistan Aeronautical Complex (PAC) K-8 (Karakorum-8) single-engine basic trainer/light attack aircraft can be powered by Ivchenko-Progress AI-25TLK turbofan engines or similarly rated Chinese-made WS11 engines. A few aircraft, such as the K-8E in service with the Egyptian Air Force, use Honeywell TFE731 engines, provided the US authorises the export of these engines.

According to Janes data, the Bangladesh Air Force (BAF) operates K-8W aircraft powered by Ukrainian engines. A first batch of nine aircraft was delivered in 2014, and in June 2018 it was reported that the BAF has signed an agreement with China for an additional 23 K-8W trainers, of which several will be used for an aerial display team. Of the second order, six or seven aircraft were delivered in late 2020. It is unclear how the delivery of the remaining aircraft will be affected by the current crisis.

Ukrainian engines also power, among others, Russian Mi-26 heavy transport helicopters and legacy Aero Vodochody L-39 lead-in fighter trainers that are primarily in service in Asia and Africa.

In 2016 Russia started developing the PD-12V engine, a variant of the Aviadvigatel PD-14 turbofan engine to power the Mi-26T2 variant, which uses two Ivchenko-Progress modernised D-136-2 engines. Initial flight tests of the re-engined heavy helicopter are scheduled to start in 2023, with approval for serial production expected in 2025. However, this timeline could suffer from additional delays in light of current events. Besides Russian forces, the Mi-26T2 helicopter is in service in Algeria.

Turkish ATAK programmes

A shortage of Motor Sich engines could also affect progress in the development of the Turkish Aerospace Industries (TUSAŞ) T929 ATAK 2 11-ton heavy attack helicopter and the pending export of T-129 ATAK attack helicopters to Pakistan.

On 29 June 2021 TUSAŞ announced that it had signed a contract with Motor Sich for the supply of 14 TV3-117 2,500 hp turboshaft engines for the ATAK 2 programme, with the first two scheduled for delivery in 2022 and the remainder until 2025. The first aircraft would conduct its maiden flight in 2023.

The delivery of the first two engines is scheduled by September 2022. At this stage, it is unclear how this timeline will be affected by the conflict.

The selection of Ukrainian engines also sought to overcome US sanctions on the sale of CTS800-4A engines built by Honeywell and Rolls-Royce joint-venture Light Helicopter Turbine Engine Company (LHTEC) to third countries without an export permission. Indeed, LHTEC engines power the T129 ATAK procured under licence from Leonardo and on which the ATAK 2 is based.

Delays in obtaining export licences for the LHTEC engines have so far hindered the sale of 30 T129s to Pakistan, which was officially announced in 2018 for USD1.5 billion, and prompted the latter to look for other options, including Chinese Changhe Aircraft Industries Corporation (CAIC) Z-10ME attack helicopter, among others.

However, in an interview with a Pakistani private TV channel on 18 February, TUSAŞ CEO Temel Kotil said that the sale of the T-129s to Pakistan had not been cancelled. Instead, TUSAŞ will deliver the 30 licenced-produced attack helicopters equipped with engines sourced from Ukraine, Kotil added.

It is unclear what alternative solution Turkey may pitch to Pakistan to replace the Ukrainian engines, if no longer available, and achieve the T129 sale.

Ukrainian Antonov legacy transport aircraft are widely in use with military operators around the wor...

Ukraine conflict: Impact on military aircraft programmes managed by Ukraine in Asia

09 March 2022

by Alessandra Giovanzanti

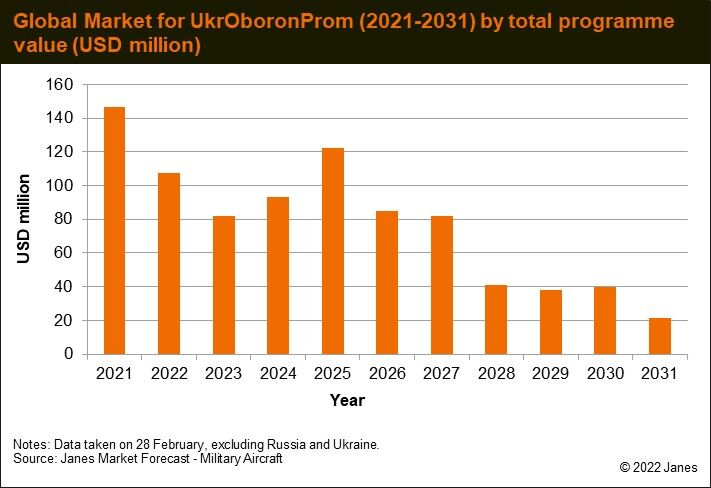

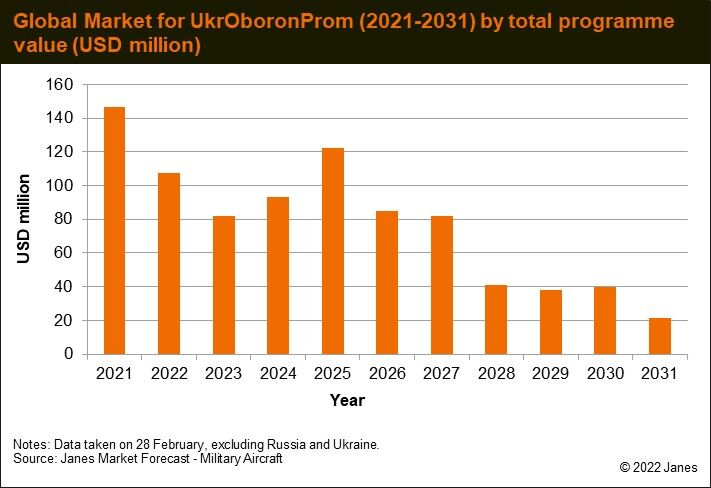

Janes Markets Forecast: Military aircraft data on the global market for UkrOboronProm during 2021–31 by the total programme value. (Janes)

Ukrainian Antonov legacy transport aircraft are widely in use with military operators around the world, while Motor Sich engines power a few legacy Russian military helicopters and fixed-wing aircraft, such as the old Aero Vodochody L-39 trainer/light attack aircraft and more modern Hongdu Aviation Industry Group Corporation (HAIC) L‐15 jet trainers.

State-owned defence conglomerate UkrOboronProm (UOP), of which Antonov is part, is also involved in a series of maintenance and upgrade programmes of Russian-made platforms operated by South Asian armed forces.

The conflict in Ukraine will likely affect the supply of parts and kits to sustain ageing Antonov aircraft, as well as of engines and upgrades to different aircraft types managed by UOP and its export entities, especially in Asia.

Ukraine's main airbases and industrial assets have been targeted since the beginning of the conflict. Antonov Airport in Hostomel, where the company is based, witnessed clashes between Russian and Ukrainian troops since day one. Meanwhile, Lviv State Aircraft Repair Plant, which has historically been servicing Kazakhstan MiG-27 and MiG-29 combat aircraft, as well as Azerbaijan, Bangladesh, and Sudan MiG-29s, was allegedly destroyed. The fate of several MiG-29 fighter aircraft of the Azerbaijan Air Forces that were receiving upgrades at the factory is unknown.

Janes Markets Forecast data for military aircraft programmes, compiled on 28 February, and excluding Russia and Ukraine, show that the market for UOP between 2021 and 2031, before the conflict, was estimated at around USD710 million.

This figure mostly includes support services for existing fleets of Antonov military aircraft and contracted maintenance, repair, and overhaul (MRO) activities for, among others, the Mi-17 fleet in service with the Bangladesh Air Force, performed in-country at a service centre opened in January 2018 by Ukrinmash, a UOP export company.

Comprised in this estimated market value are also the ongoing upgrades for the An-32 fleet of the Indian Air Force and the Ilyushin Il-78 transport/tanker fleet of the Pakistan Air Force (PAF).

Inventory of Antonov aircraft around the world

A significant number of Antonov legacy transport aircraft, manufactured during the Soviet era, are flown by several armed forces around the world. Janes Inventory data suggest that, excluding Russia and Ukraine, about 300 Antonov military aircraft are in service, including special mission variants. About 63% of these aircraft are in service with armed forces in Asia (including a number of An-2 aircraft that have been modified to kamikaze unmanned aerial vehicles in Azerbaijan).

Russia remains to be the largest operator of Antonov transport aircraft, with more than 300 aircraft ranging from An-2 and An-26 to the more recent An-140 and An-148. Since 2014, Russia has been looking for alternative sources to sustain Antonov aircraft and manufacture replacement platforms, as well as substitute existing Ukrainian engines that power a range of fixed-wing aircraft and military helicopters, including Mi and Ka medium-class helicopters, Yak-130 trainers, Be-200 amphibious aircraft, and An-124 and An-148 transport aircraft.

Besides Russia, the Antonov light to medium/heavy airlifters are widely used in Asia, with India operating more than 100 An-32 twin-turboprop tactical transport aircraft.

Most of these aircraft are more than 30 years old, with a few being upgraded, while the majority of others are in need of replacement or about to be retired. Janes assesses that the current crisis could accelerate replacement programmes and the retirement of such assets.

At present, there is no export order from military operators for the An-178, Antonov's only new-build twin-turbofan medium-lift military aircraft, while Antonov's attempts in the mid-late 2010s to establish partnerships to co-produce military airlifters, such as the An-132 with Saudi Arabia and then An-132D maritime patrol aircraft with Turkey, have also failed.

The most recent contract activity was the renewal in November 2021 for the NATO's Strategic Air Lift International Solution (SALIS) programme that provides outsized cargo airlift to nine NATO countries, with up to five An-124 aircraft contracted to be available within a few days of tasking. Other aircraft, including An-22, An-225, and Ilyushin IL-76 aircraft, can be mobilised as required under SALIS.

It is unclear how the conflict will affect Antonov aircraft's availability for the SALIS programme, although a subsidiary business, Antonov Logistics SALIS GmbH, has its base of operations at the Leipzig/Halle airport in Germany.

The 18-tonne-payload An-178 was originally set to replace the An-12 ‘Cub', the An-26 ‘Curl', and the An-32 ‘Cline' airlifters in service with the Ukrainian Air Force, but was also seen as a viable contender on the international fixed-wing medium-lift market.

Although past interest has been reported by the armed forces of Azerbaijan and Peru, this has not led to acquisitions, and only civil or law enforcement operators have ordered the An-178 so far. Nonetheless, the conflict in Ukraine also puts these existing An-178 orders at risk, such as the one for the National Police of Peru. Janes understands the Peruvian government would have paid for the aircraft only upon its completion and that the aircraft were in their final assembly stage at Antonov's facilities in Kyiv during the attack by Russian forces.

Military aircraft programmes in Asia at risk

The Ukrainian industry is also working on the modernisation of different aircraft types in service in Asia.

The Indian Air Force is upgrading its fleet of about 104 An-32 tactical transport aircraft to the An-32 RE standard to extend their service life and provide new avionics, a modern cockpit layout, and work for the reduction of noise and vibration levels

The programme started in 2009 but stalled in 2014 after the first 35–40 units were upgraded in Ukraine, as Moscow refused to transfer key equipment to Kyiv in the aftermath of the Crimea conflict. The programme resumed in early 2019, as Ukraine developed alternatives to the Russian-made systems for the aircraft. The remaining platforms are scheduled to be upgraded in India in a phased manner depending upon the supply of modification kits by Ukraine.

This programme has suffered from additional delays in its local assembly phase, and its completion is projected at around 2025. The conflict could further affect this programme, as the status of the shipments from Ukraine is unknown.

After upgrading a first aircraft in Russia, Pakistan turned to UOP for the upgrade of a second Il-78 transport/tanker aircraft. The contract, valued at USD30 million in June 2020, also included an option to upgrade the remaining two aircraft in service with the PAF.

Although the first aircraft upgraded in Ukraine was returned to the PAF in early 2022, the option for the remaining two aircraft may not be exercised at this stage, and Pakistan may look for alternative sources or decide not to upgrade the last two Il-78s and proceed with a replacement programme instead.

Motor Sich engines

Ukraine is also a supplier of engines for military aircraft. Until 2014, Motor Sich had a virtual monopoly on the supply of certain military helicopter engines to Russian Helicopters, and also currently provides the AI‐222‐25F engine that powers the HAIC L‐15 jet trainer.

Looking at Ukraine as a supplier of engines to export customers and leveraging Janes Markets Forecast data, Janes has identified additional military aircraft programmes that could be affected by the Ukrainian conflict.

The Chinese L-15/JL-10 advanced trainer aircraft is powered by Ivchenko-Progress AI-222K-25F turbofan engines, and is in service with the People's Liberation Army Air Force (PLAAF), the People's Liberation Army Navy (PLAN), and the Zambian Air Force, with Chinese operators still receiving the aircraft.

It is unclear how the conflict will affect the recently signed deal between the United Arab Emirates Ministry of Defence and China National Aero-Technology Import & Export Corporation (CATIC) for the acquisition of 12 L-15 aircraft for the UAE Air Force and Air Defence (AFAD), with options for a further 36 to follow.

However, Janes understands that China co-produces the engines (also known as WS15 ‘Emei') and can autonomously supply these engines to export customers. Moreover, China is known to be testing a locally developed engine for its JL-10 trainer aircraft, although initially this would likely be in use just for domestic aircraft.

HAIC and Pakistan Aeronautical Complex (PAC) K-8 (Karakorum-8) single-engine basic trainer/light attack aircraft can be powered by Ivchenko-Progress AI-25TLK turbofan engines or similarly rated Chinese-made WS11 engines. A few aircraft, such as the K-8E in service with the Egyptian Air Force, use Honeywell TFE731 engines, provided the US authorises the export of these engines.

According to Janes data, the Bangladesh Air Force (BAF) operates K-8W aircraft powered by Ukrainian engines. A first batch of nine aircraft was delivered in 2014, and in June 2018 it was reported that the BAF has signed an agreement with China for an additional 23 K-8W trainers, of which several will be used for an aerial display team. Of the second order, six or seven aircraft were delivered in late 2020. It is unclear how the delivery of the remaining aircraft will be affected by the current crisis.

Ukrainian engines also power, among others, Russian Mi-26 heavy transport helicopters and legacy Aero Vodochody L-39 lead-in fighter trainers that are primarily in service in Asia and Africa.

In 2016 Russia started developing the PD-12V engine, a variant of the Aviadvigatel PD-14 turbofan engine to power the Mi-26T2 variant, which uses two Ivchenko-Progress modernised D-136-2 engines. Initial flight tests of the re-engined heavy helicopter are scheduled to start in 2023, with approval for serial production expected in 2025. However, this timeline could suffer from additional delays in light of current events. Besides Russian forces, the Mi-26T2 helicopter is in service in Algeria.

Turkish ATAK programmes

A shortage of Motor Sich engines could also affect progress in the development of the Turkish Aerospace Industries (TUSAŞ) T929 ATAK 2 11-ton heavy attack helicopter and the pending export of T-129 ATAK attack helicopters to Pakistan.

On 29 June 2021 TUSAŞ announced that it had signed a contract with Motor Sich for the supply of 14 TV3-117 2,500 hp turboshaft engines for the ATAK 2 programme, with the first two scheduled for delivery in 2022 and the remainder until 2025. The first aircraft would conduct its maiden flight in 2023.

The delivery of the first two engines is scheduled by September 2022. At this stage, it is unclear how this timeline will be affected by the conflict.

The selection of Ukrainian engines also sought to overcome US sanctions on the sale of CTS800-4A engines built by Honeywell and Rolls-Royce joint-venture Light Helicopter Turbine Engine Company (LHTEC) to third countries without an export permission. Indeed, LHTEC engines power the T129 ATAK procured under licence from Leonardo and on which the ATAK 2 is based.

Delays in obtaining export licences for the LHTEC engines have so far hindered the sale of 30 T129s to Pakistan, which was officially announced in 2018 for USD1.5 billion, and prompted the latter to look for other options, including Chinese Changhe Aircraft Industries Corporation (CAIC) Z-10ME attack helicopter, among others.

However, in an interview with a Pakistani private TV channel on 18 February, TUSAŞ CEO Temel Kotil said that the sale of the T-129s to Pakistan had not been cancelled. Instead, TUSAŞ will deliver the 30 licenced-produced attack helicopters equipped with engines sourced from Ukraine, Kotil added.

It is unclear what alternative solution Turkey may pitch to Pakistan to replace the Ukrainian engines, if no longer available, and achieve the T129 sale.

Ukrainian Antonov legacy transport aircraft are widely in use with military operators around the wor...

Ukraine conflict: Impact on military aircraft programmes managed by Ukraine in Asia

09 March 2022

by Alessandra Giovanzanti

Janes Markets Forecast: Military aircraft data on the global market for UkrOboronProm during 2021–31 by the total programme value. (Janes)

Ukrainian Antonov legacy transport aircraft are widely in use with military operators around the world, while Motor Sich engines power a few legacy Russian military helicopters and fixed-wing aircraft, such as the old Aero Vodochody L-39 trainer/light attack aircraft and more modern Hongdu Aviation Industry Group Corporation (HAIC) L‐15 jet trainers.

State-owned defence conglomerate UkrOboronProm (UOP), of which Antonov is part, is also involved in a series of maintenance and upgrade programmes of Russian-made platforms operated by South Asian armed forces.

The conflict in Ukraine will likely affect the supply of parts and kits to sustain ageing Antonov aircraft, as well as of engines and upgrades to different aircraft types managed by UOP and its export entities, especially in Asia.

Ukraine's main airbases and industrial assets have been targeted since the beginning of the conflict. Antonov Airport in Hostomel, where the company is based, witnessed clashes between Russian and Ukrainian troops since day one. Meanwhile, Lviv State Aircraft Repair Plant, which has historically been servicing Kazakhstan MiG-27 and MiG-29 combat aircraft, as well as Azerbaijan, Bangladesh, and Sudan MiG-29s, was allegedly destroyed. The fate of several MiG-29 fighter aircraft of the Azerbaijan Air Forces that were receiving upgrades at the factory is unknown.

Janes Markets Forecast data for military aircraft programmes, compiled on 28 February, and excluding Russia and Ukraine, show that the market for UOP between 2021 and 2031, before the conflict, was estimated at around USD710 million.

This figure mostly includes support services for existing fleets of Antonov military aircraft and contracted maintenance, repair, and overhaul (MRO) activities for, among others, the Mi-17 fleet in service with the Bangladesh Air Force, performed in-country at a service centre opened in January 2018 by Ukrinmash, a UOP export company.

Comprised in this estimated market value are also the ongoing upgrades for the An-32 fleet of the Indian Air Force and the Ilyushin Il-78 transport/tanker fleet of the Pakistan Air Force (PAF).

Inventory of Antonov aircraft around the world

A significant number of Antonov legacy transport aircraft, manufactured during the Soviet era, are flown by several armed forces around the world. Janes Inventory data suggest that, excluding Russia and Ukraine, about 300 Antonov military aircraft are in service, including special mission variants. About 63% of these aircraft are in service with armed forces in Asia (including a number of An-2 aircraft that have been modified to kamikaze unmanned aerial vehicles in Azerbaijan).

Russia remains to be the largest operator of Antonov transport aircraft, with more than 300 aircraft ranging from An-2 and An-26 to the more recent An-140 and An-148. Since 2014, Russia has been looking for alternative sources to sustain Antonov aircraft and manufacture replacement platforms, as well as substitute existing Ukrainian engines that power a range of fixed-wing aircraft and military helicopters, including Mi and Ka medium-class helicopters, Yak-130 trainers, Be-200 amphibious aircraft, and An-124 and An-148 transport aircraft.

Besides Russia, the Antonov light to medium/heavy airlifters are widely used in Asia, with India operating more than 100 An-32 twin-turboprop tactical transport aircraft.

Most of these aircraft are more than 30 years old, with a few being upgraded, while the majority of others are in need of replacement or about to be retired. Janes assesses that the current crisis could accelerate replacement programmes and the retirement of such assets.

At present, there is no export order from military operators for the An-178, Antonov's only new-build twin-turbofan medium-lift military aircraft, while Antonov's attempts in the mid-late 2010s to establish partnerships to co-produce military airlifters, such as the An-132 with Saudi Arabia and then An-132D maritime patrol aircraft with Turkey, have also failed.

The most recent contract activity was the renewal in November 2021 for the NATO's Strategic Air Lift International Solution (SALIS) programme that provides outsized cargo airlift to nine NATO countries, with up to five An-124 aircraft contracted to be available within a few days of tasking. Other aircraft, including An-22, An-225, and Ilyushin IL-76 aircraft, can be mobilised as required under SALIS.

It is unclear how the conflict will affect Antonov aircraft's availability for the SALIS programme, although a subsidiary business, Antonov Logistics SALIS GmbH, has its base of operations at the Leipzig/Halle airport in Germany.

The 18-tonne-payload An-178 was originally set to replace the An-12 ‘Cub', the An-26 ‘Curl', and the An-32 ‘Cline' airlifters in service with the Ukrainian Air Force, but was also seen as a viable contender on the international fixed-wing medium-lift market.

Although past interest has been reported by the armed forces of Azerbaijan and Peru, this has not led to acquisitions, and only civil or law enforcement operators have ordered the An-178 so far. Nonetheless, the conflict in Ukraine also puts these existing An-178 orders at risk, such as the one for the National Police of Peru. Janes understands the Peruvian government would have paid for the aircraft only upon its completion and that the aircraft were in their final assembly stage at Antonov's facilities in Kyiv during the attack by Russian forces.

Military aircraft programmes in Asia at risk

The Ukrainian industry is also working on the modernisation of different aircraft types in service in Asia.

The Indian Air Force is upgrading its fleet of about 104 An-32 tactical transport aircraft to the An-32 RE standard to extend their service life and provide new avionics, a modern cockpit layout, and work for the reduction of noise and vibration levels

The programme started in 2009 but stalled in 2014 after the first 35–40 units were upgraded in Ukraine, as Moscow refused to transfer key equipment to Kyiv in the aftermath of the Crimea conflict. The programme resumed in early 2019, as Ukraine developed alternatives to the Russian-made systems for the aircraft. The remaining platforms are scheduled to be upgraded in India in a phased manner depending upon the supply of modification kits by Ukraine.

This programme has suffered from additional delays in its local assembly phase, and its completion is projected at around 2025. The conflict could further affect this programme, as the status of the shipments from Ukraine is unknown.

After upgrading a first aircraft in Russia, Pakistan turned to UOP for the upgrade of a second Il-78 transport/tanker aircraft. The contract, valued at USD30 million in June 2020, also included an option to upgrade the remaining two aircraft in service with the PAF.

Although the first aircraft upgraded in Ukraine was returned to the PAF in early 2022, the option for the remaining two aircraft may not be exercised at this stage, and Pakistan may look for alternative sources or decide not to upgrade the last two Il-78s and proceed with a replacement programme instead.

Motor Sich engines

Ukraine is also a supplier of engines for military aircraft. Until 2014, Motor Sich had a virtual monopoly on the supply of certain military helicopter engines to Russian Helicopters, and also currently provides the AI‐222‐25F engine that powers the HAIC L‐15 jet trainer.

Looking at Ukraine as a supplier of engines to export customers and leveraging Janes Markets Forecast data, Janes has identified additional military aircraft programmes that could be affected by the Ukrainian conflict.

The Chinese L-15/JL-10 advanced trainer aircraft is powered by Ivchenko-Progress AI-222K-25F turbofan engines, and is in service with the People's Liberation Army Air Force (PLAAF), the People's Liberation Army Navy (PLAN), and the Zambian Air Force, with Chinese operators still receiving the aircraft.

It is unclear how the conflict will affect the recently signed deal between the United Arab Emirates Ministry of Defence and China National Aero-Technology Import & Export Corporation (CATIC) for the acquisition of 12 L-15 aircraft for the UAE Air Force and Air Defence (AFAD), with options for a further 36 to follow.

However, Janes understands that China co-produces the engines (also known as WS15 ‘Emei') and can autonomously supply these engines to export customers. Moreover, China is known to be testing a locally developed engine for its JL-10 trainer aircraft, although initially this would likely be in use just for domestic aircraft.

HAIC and Pakistan Aeronautical Complex (PAC) K-8 (Karakorum-8) single-engine basic trainer/light attack aircraft can be powered by Ivchenko-Progress AI-25TLK turbofan engines or similarly rated Chinese-made WS11 engines. A few aircraft, such as the K-8E in service with the Egyptian Air Force, use Honeywell TFE731 engines, provided the US authorises the export of these engines.

According to Janes data, the Bangladesh Air Force (BAF) operates K-8W aircraft powered by Ukrainian engines. A first batch of nine aircraft was delivered in 2014, and in June 2018 it was reported that the BAF has signed an agreement with China for an additional 23 K-8W trainers, of which several will be used for an aerial display team. Of the second order, six or seven aircraft were delivered in late 2020. It is unclear how the delivery of the remaining aircraft will be affected by the current crisis.

Ukrainian engines also power, among others, Russian Mi-26 heavy transport helicopters and legacy Aero Vodochody L-39 lead-in fighter trainers that are primarily in service in Asia and Africa.

In 2016 Russia started developing the PD-12V engine, a variant of the Aviadvigatel PD-14 turbofan engine to power the Mi-26T2 variant, which uses two Ivchenko-Progress modernised D-136-2 engines. Initial flight tests of the re-engined heavy helicopter are scheduled to start in 2023, with approval for serial production expected in 2025. However, this timeline could suffer from additional delays in light of current events. Besides Russian forces, the Mi-26T2 helicopter is in service in Algeria.

Turkish ATAK programmes

A shortage of Motor Sich engines could also affect progress in the development of the Turkish Aerospace Industries (TUSAŞ) T929 ATAK 2 11-ton heavy attack helicopter and the pending export of T-129 ATAK attack helicopters to Pakistan.

On 29 June 2021 TUSAŞ announced that it had signed a contract with Motor Sich for the supply of 14 TV3-117 2,500 hp turboshaft engines for the ATAK 2 programme, with the first two scheduled for delivery in 2022 and the remainder until 2025. The first aircraft would conduct its maiden flight in 2023.

The delivery of the first two engines is scheduled by September 2022. At this stage, it is unclear how this timeline will be affected by the conflict.

The selection of Ukrainian engines also sought to overcome US sanctions on the sale of CTS800-4A engines built by Honeywell and Rolls-Royce joint-venture Light Helicopter Turbine Engine Company (LHTEC) to third countries without an export permission. Indeed, LHTEC engines power the T129 ATAK procured under licence from Leonardo and on which the ATAK 2 is based.

Delays in obtaining export licences for the LHTEC engines have so far hindered the sale of 30 T129s to Pakistan, which was officially announced in 2018 for USD1.5 billion, and prompted the latter to look for other options, including Chinese Changhe Aircraft Industries Corporation (CAIC) Z-10ME attack helicopter, among others.

However, in an interview with a Pakistani private TV channel on 18 February, TUSAŞ CEO Temel Kotil said that the sale of the T-129s to Pakistan had not been cancelled. Instead, TUSAŞ will deliver the 30 licenced-produced attack helicopters equipped with engines sourced from Ukraine, Kotil added.

It is unclear what alternative solution Turkey may pitch to Pakistan to replace the Ukrainian engines, if no longer available, and achieve the T129 sale.

Ukrainian Antonov legacy transport aircraft are widely in use with military operators around the wor...

Ukraine conflict: Impact on military aircraft programmes managed by Ukraine in Asia

09 March 2022

by Alessandra Giovanzanti

Janes Markets Forecast: Military aircraft data on the global market for UkrOboronProm during 2021–31 by the total programme value. (Janes)

Ukrainian Antonov legacy transport aircraft are widely in use with military operators around the world, while Motor Sich engines power a few legacy Russian military helicopters and fixed-wing aircraft, such as the old Aero Vodochody L-39 trainer/light attack aircraft and more modern Hongdu Aviation Industry Group Corporation (HAIC) L‐15 jet trainers.

State-owned defence conglomerate UkrOboronProm (UOP), of which Antonov is part, is also involved in a series of maintenance and upgrade programmes of Russian-made platforms operated by South Asian armed forces.

The conflict in Ukraine will likely affect the supply of parts and kits to sustain ageing Antonov aircraft, as well as of engines and upgrades to different aircraft types managed by UOP and its export entities, especially in Asia.

Ukraine's main airbases and industrial assets have been targeted since the beginning of the conflict. Antonov Airport in Hostomel, where the company is based, witnessed clashes between Russian and Ukrainian troops since day one. Meanwhile, Lviv State Aircraft Repair Plant, which has historically been servicing Kazakhstan MiG-27 and MiG-29 combat aircraft, as well as Azerbaijan, Bangladesh, and Sudan MiG-29s, was allegedly destroyed. The fate of several MiG-29 fighter aircraft of the Azerbaijan Air Forces that were receiving upgrades at the factory is unknown.

Janes Markets Forecast data for military aircraft programmes, compiled on 28 February, and excluding Russia and Ukraine, show that the market for UOP between 2021 and 2031, before the conflict, was estimated at around USD710 million.

This figure mostly includes support services for existing fleets of Antonov military aircraft and contracted maintenance, repair, and overhaul (MRO) activities for, among others, the Mi-17 fleet in service with the Bangladesh Air Force, performed in-country at a service centre opened in January 2018 by Ukrinmash, a UOP export company.

Comprised in this estimated market value are also the ongoing upgrades for the An-32 fleet of the Indian Air Force and the Ilyushin Il-78 transport/tanker fleet of the Pakistan Air Force (PAF).

Inventory of Antonov aircraft around the world

A significant number of Antonov legacy transport aircraft, manufactured during the Soviet era, are flown by several armed forces around the world. Janes Inventory data suggest that, excluding Russia and Ukraine, about 300 Antonov military aircraft are in service, including special mission variants. About 63% of these aircraft are in service with armed forces in Asia (including a number of An-2 aircraft that have been modified to kamikaze unmanned aerial vehicles in Azerbaijan).

Russia remains to be the largest operator of Antonov transport aircraft, with more than 300 aircraft ranging from An-2 and An-26 to the more recent An-140 and An-148. Since 2014, Russia has been looking for alternative sources to sustain Antonov aircraft and manufacture replacement platforms, as well as substitute existing Ukrainian engines that power a range of fixed-wing aircraft and military helicopters, including Mi and Ka medium-class helicopters, Yak-130 trainers, Be-200 amphibious aircraft, and An-124 and An-148 transport aircraft.

Besides Russia, the Antonov light to medium/heavy airlifters are widely used in Asia, with India operating more than 100 An-32 twin-turboprop tactical transport aircraft.

Most of these aircraft are more than 30 years old, with a few being upgraded, while the majority of others are in need of replacement or about to be retired. Janes assesses that the current crisis could accelerate replacement programmes and the retirement of such assets.

At present, there is no export order from military operators for the An-178, Antonov's only new-build twin-turbofan medium-lift military aircraft, while Antonov's attempts in the mid-late 2010s to establish partnerships to co-produce military airlifters, such as the An-132 with Saudi Arabia and then An-132D maritime patrol aircraft with Turkey, have also failed.

The most recent contract activity was the renewal in November 2021 for the NATO's Strategic Air Lift International Solution (SALIS) programme that provides outsized cargo airlift to nine NATO countries, with up to five An-124 aircraft contracted to be available within a few days of tasking. Other aircraft, including An-22, An-225, and Ilyushin IL-76 aircraft, can be mobilised as required under SALIS.

It is unclear how the conflict will affect Antonov aircraft's availability for the SALIS programme, although a subsidiary business, Antonov Logistics SALIS GmbH, has its base of operations at the Leipzig/Halle airport in Germany.

The 18-tonne-payload An-178 was originally set to replace the An-12 ‘Cub', the An-26 ‘Curl', and the An-32 ‘Cline' airlifters in service with the Ukrainian Air Force, but was also seen as a viable contender on the international fixed-wing medium-lift market.

Although past interest has been reported by the armed forces of Azerbaijan and Peru, this has not led to acquisitions, and only civil or law enforcement operators have ordered the An-178 so far. Nonetheless, the conflict in Ukraine also puts these existing An-178 orders at risk, such as the one for the National Police of Peru. Janes understands the Peruvian government would have paid for the aircraft only upon its completion and that the aircraft were in their final assembly stage at Antonov's facilities in Kyiv during the attack by Russian forces.

Military aircraft programmes in Asia at risk

The Ukrainian industry is also working on the modernisation of different aircraft types in service in Asia.

The Indian Air Force is upgrading its fleet of about 104 An-32 tactical transport aircraft to the An-32 RE standard to extend their service life and provide new avionics, a modern cockpit layout, and work for the reduction of noise and vibration levels

The programme started in 2009 but stalled in 2014 after the first 35–40 units were upgraded in Ukraine, as Moscow refused to transfer key equipment to Kyiv in the aftermath of the Crimea conflict. The programme resumed in early 2019, as Ukraine developed alternatives to the Russian-made systems for the aircraft. The remaining platforms are scheduled to be upgraded in India in a phased manner depending upon the supply of modification kits by Ukraine.

This programme has suffered from additional delays in its local assembly phase, and its completion is projected at around 2025. The conflict could further affect this programme, as the status of the shipments from Ukraine is unknown.

After upgrading a first aircraft in Russia, Pakistan turned to UOP for the upgrade of a second Il-78 transport/tanker aircraft. The contract, valued at USD30 million in June 2020, also included an option to upgrade the remaining two aircraft in service with the PAF.

Although the first aircraft upgraded in Ukraine was returned to the PAF in early 2022, the option for the remaining two aircraft may not be exercised at this stage, and Pakistan may look for alternative sources or decide not to upgrade the last two Il-78s and proceed with a replacement programme instead.

Motor Sich engines

Ukraine is also a supplier of engines for military aircraft. Until 2014, Motor Sich had a virtual monopoly on the supply of certain military helicopter engines to Russian Helicopters, and also currently provides the AI‐222‐25F engine that powers the HAIC L‐15 jet trainer.

Looking at Ukraine as a supplier of engines to export customers and leveraging Janes Markets Forecast data, Janes has identified additional military aircraft programmes that could be affected by the Ukrainian conflict.

The Chinese L-15/JL-10 advanced trainer aircraft is powered by Ivchenko-Progress AI-222K-25F turbofan engines, and is in service with the People's Liberation Army Air Force (PLAAF), the People's Liberation Army Navy (PLAN), and the Zambian Air Force, with Chinese operators still receiving the aircraft.

It is unclear how the conflict will affect the recently signed deal between the United Arab Emirates Ministry of Defence and China National Aero-Technology Import & Export Corporation (CATIC) for the acquisition of 12 L-15 aircraft for the UAE Air Force and Air Defence (AFAD), with options for a further 36 to follow.

However, Janes understands that China co-produces the engines (also known as WS15 ‘Emei') and can autonomously supply these engines to export customers. Moreover, China is known to be testing a locally developed engine for its JL-10 trainer aircraft, although initially this would likely be in use just for domestic aircraft.

HAIC and Pakistan Aeronautical Complex (PAC) K-8 (Karakorum-8) single-engine basic trainer/light attack aircraft can be powered by Ivchenko-Progress AI-25TLK turbofan engines or similarly rated Chinese-made WS11 engines. A few aircraft, such as the K-8E in service with the Egyptian Air Force, use Honeywell TFE731 engines, provided the US authorises the export of these engines.

According to Janes data, the Bangladesh Air Force (BAF) operates K-8W aircraft powered by Ukrainian engines. A first batch of nine aircraft was delivered in 2014, and in June 2018 it was reported that the BAF has signed an agreement with China for an additional 23 K-8W trainers, of which several will be used for an aerial display team. Of the second order, six or seven aircraft were delivered in late 2020. It is unclear how the delivery of the remaining aircraft will be affected by the current crisis.

Ukrainian engines also power, among others, Russian Mi-26 heavy transport helicopters and legacy Aero Vodochody L-39 lead-in fighter trainers that are primarily in service in Asia and Africa.

In 2016 Russia started developing the PD-12V engine, a variant of the Aviadvigatel PD-14 turbofan engine to power the Mi-26T2 variant, which uses two Ivchenko-Progress modernised D-136-2 engines. Initial flight tests of the re-engined heavy helicopter are scheduled to start in 2023, with approval for serial production expected in 2025. However, this timeline could suffer from additional delays in light of current events. Besides Russian forces, the Mi-26T2 helicopter is in service in Algeria.

Turkish ATAK programmes

A shortage of Motor Sich engines could also affect progress in the development of the Turkish Aerospace Industries (TUSAŞ) T929 ATAK 2 11-ton heavy attack helicopter and the pending export of T-129 ATAK attack helicopters to Pakistan.

On 29 June 2021 TUSAŞ announced that it had signed a contract with Motor Sich for the supply of 14 TV3-117 2,500 hp turboshaft engines for the ATAK 2 programme, with the first two scheduled for delivery in 2022 and the remainder until 2025. The first aircraft would conduct its maiden flight in 2023.

The delivery of the first two engines is scheduled by September 2022. At this stage, it is unclear how this timeline will be affected by the conflict.

The selection of Ukrainian engines also sought to overcome US sanctions on the sale of CTS800-4A engines built by Honeywell and Rolls-Royce joint-venture Light Helicopter Turbine Engine Company (LHTEC) to third countries without an export permission. Indeed, LHTEC engines power the T129 ATAK procured under licence from Leonardo and on which the ATAK 2 is based.

Delays in obtaining export licences for the LHTEC engines have so far hindered the sale of 30 T129s to Pakistan, which was officially announced in 2018 for USD1.5 billion, and prompted the latter to look for other options, including Chinese Changhe Aircraft Industries Corporation (CAIC) Z-10ME attack helicopter, among others.

However, in an interview with a Pakistani private TV channel on 18 February, TUSAŞ CEO Temel Kotil said that the sale of the T-129s to Pakistan had not been cancelled. Instead, TUSAŞ will deliver the 30 licenced-produced attack helicopters equipped with engines sourced from Ukraine, Kotil added.

It is unclear what alternative solution Turkey may pitch to Pakistan to replace the Ukrainian engines, if no longer available, and achieve the T129 sale.

Ukrainian Antonov legacy transport aircraft are widely in use with military operators around the wor...

Ukraine conflict: Impact on military aircraft programmes managed by Ukraine in Asia

09 March 2022

by Alessandra Giovanzanti

Janes Markets Forecast: Military aircraft data on the global market for UkrOboronProm during 2021–31 by the total programme value. (Janes)

Ukrainian Antonov legacy transport aircraft are widely in use with military operators around the world, while Motor Sich engines power a few legacy Russian military helicopters and fixed-wing aircraft, such as the old Aero Vodochody L-39 trainer/light attack aircraft and more modern Hongdu Aviation Industry Group Corporation (HAIC) L‐15 jet trainers.

State-owned defence conglomerate UkrOboronProm (UOP), of which Antonov is part, is also involved in a series of maintenance and upgrade programmes of Russian-made platforms operated by South Asian armed forces.

The conflict in Ukraine will likely affect the supply of parts and kits to sustain ageing Antonov aircraft, as well as of engines and upgrades to different aircraft types managed by UOP and its export entities, especially in Asia.

Ukraine's main airbases and industrial assets have been targeted since the beginning of the conflict. Antonov Airport in Hostomel, where the company is based, witnessed clashes between Russian and Ukrainian troops since day one. Meanwhile, Lviv State Aircraft Repair Plant, which has historically been servicing Kazakhstan MiG-27 and MiG-29 combat aircraft, as well as Azerbaijan, Bangladesh, and Sudan MiG-29s, was allegedly destroyed. The fate of several MiG-29 fighter aircraft of the Azerbaijan Air Forces that were receiving upgrades at the factory is unknown.

Janes Markets Forecast data for military aircraft programmes, compiled on 28 February, and excluding Russia and Ukraine, show that the market for UOP between 2021 and 2031, before the conflict, was estimated at around USD710 million.

This figure mostly includes support services for existing fleets of Antonov military aircraft and contracted maintenance, repair, and overhaul (MRO) activities for, among others, the Mi-17 fleet in service with the Bangladesh Air Force, performed in-country at a service centre opened in January 2018 by Ukrinmash, a UOP export company.

Comprised in this estimated market value are also the ongoing upgrades for the An-32 fleet of the Indian Air Force and the Ilyushin Il-78 transport/tanker fleet of the Pakistan Air Force (PAF).

Inventory of Antonov aircraft around the world

A significant number of Antonov legacy transport aircraft, manufactured during the Soviet era, are flown by several armed forces around the world. Janes Inventory data suggest that, excluding Russia and Ukraine, about 300 Antonov military aircraft are in service, including special mission variants. About 63% of these aircraft are in service with armed forces in Asia (including a number of An-2 aircraft that have been modified to kamikaze unmanned aerial vehicles in Azerbaijan).

Russia remains to be the largest operator of Antonov transport aircraft, with more than 300 aircraft ranging from An-2 and An-26 to the more recent An-140 and An-148. Since 2014, Russia has been looking for alternative sources to sustain Antonov aircraft and manufacture replacement platforms, as well as substitute existing Ukrainian engines that power a range of fixed-wing aircraft and military helicopters, including Mi and Ka medium-class helicopters, Yak-130 trainers, Be-200 amphibious aircraft, and An-124 and An-148 transport aircraft.

Besides Russia, the Antonov light to medium/heavy airlifters are widely used in Asia, with India operating more than 100 An-32 twin-turboprop tactical transport aircraft.