- About

- Intara

- Capabilities

- Advisory

- Resources

- News

- Store

Janes - News page

- Home

- News

Mercury Systems adopts anti-takeover tactic

29 December 2021

by Marc Selinger

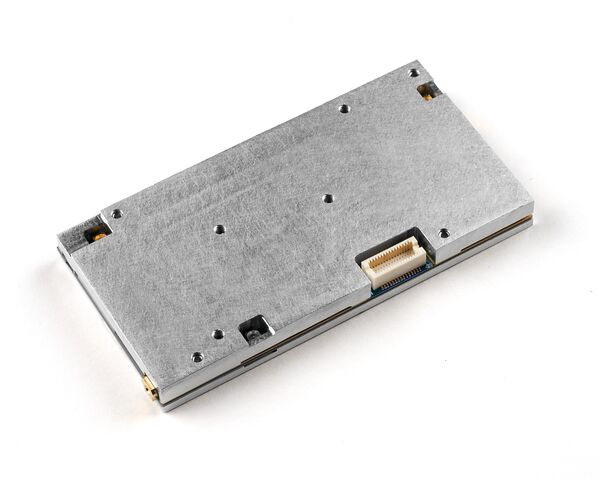

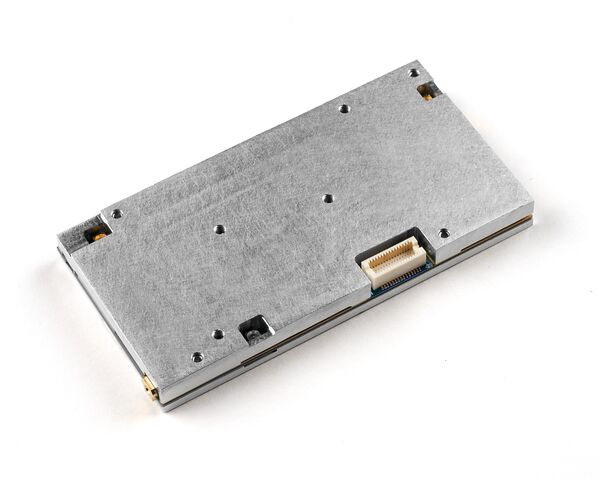

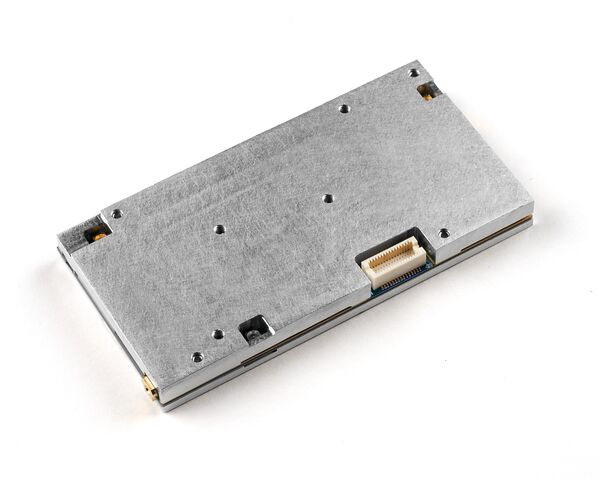

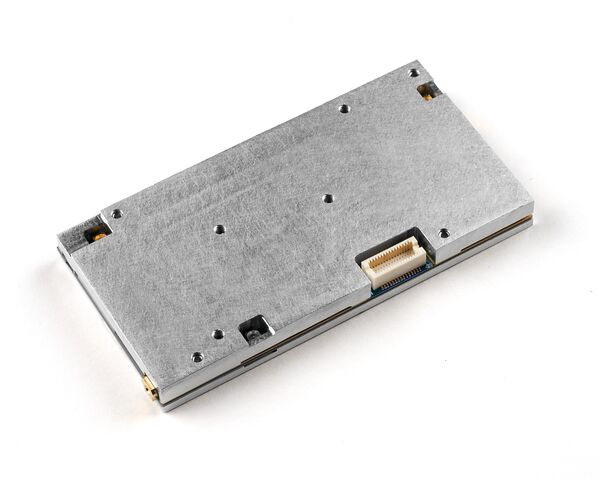

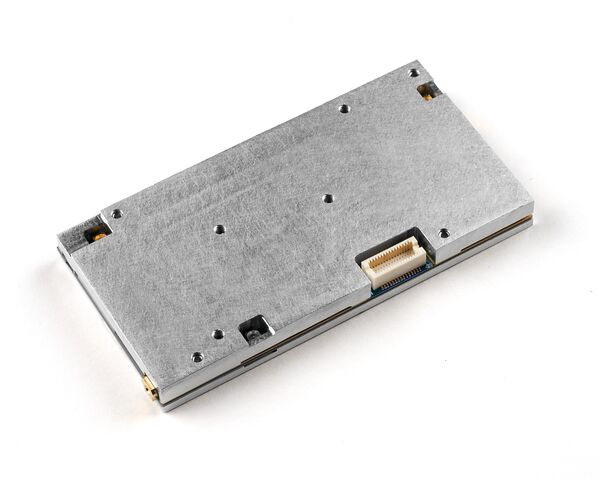

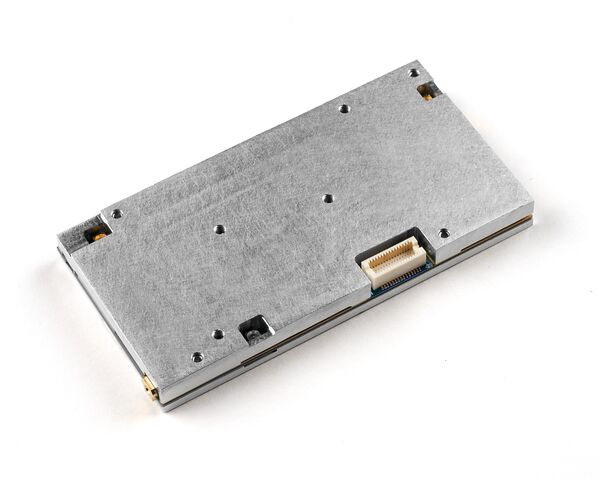

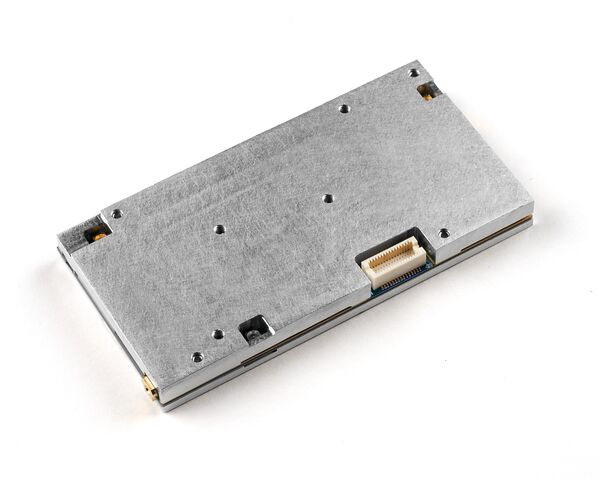

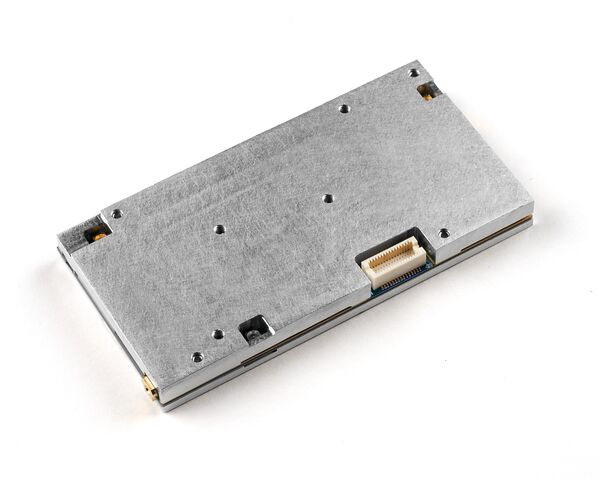

Mercury Systems recently acquired Atlanta Micro, whose AM9017 Miniature Tuner can help detect a hostile electronic warfare system. (Mercury Systems' Atlanta Micro)

Mercury Systems' board of directors has approved a shareholder rights plan, commonly known as a poison pill, to prevent an unwelcome party from gaining control of the company, the US defence electronics supplier announced on 28 December.

Under the plan, if someone acquires 7.5% or more of Mercury's common shares without the board's approval, the company's other shareholders will have the right to buy preferred shares at twice the market value of the common shares. The proliferation of shares can make a hostile takeover too expensive.

Mercury said the rights plan, which has a one-year duration, is needed to reduce “the likelihood that any person or group gains control of the company without paying full and fair value”. Mercury believes its shares, which trade on the Nasdaq stock exchange, are undervalued.

“The Mercury board unanimously adopted the rights plan to protect the investment of shareholders during a period in which it believes shares of the company do not reflect the inherent value of the business or its long-term growth potential,” the company said.

Mercury Systems' board of directors has approved a shareholder rights plan, commonly known as a pois...

Mercury Systems adopts anti-takeover tactic

29 December 2021

by Marc Selinger

Mercury Systems recently acquired Atlanta Micro, whose AM9017 Miniature Tuner can help detect a hostile electronic warfare system. (Mercury Systems' Atlanta Micro)

Mercury Systems' board of directors has approved a shareholder rights plan, commonly known as a poison pill, to prevent an unwelcome party from gaining control of the company, the US defence electronics supplier announced on 28 December.

Under the plan, if someone acquires 7.5% or more of Mercury's common shares without the board's approval, the company's other shareholders will have the right to buy preferred shares at twice the market value of the common shares. The proliferation of shares can make a hostile takeover too expensive.

Mercury said the rights plan, which has a one-year duration, is needed to reduce “the likelihood that any person or group gains control of the company without paying full and fair value”. Mercury believes its shares, which trade on the Nasdaq stock exchange, are undervalued.

“The Mercury board unanimously adopted the rights plan to protect the investment of shareholders during a period in which it believes shares of the company do not reflect the inherent value of the business or its long-term growth potential,” the company said.

Mercury Systems' board of directors has approved a shareholder rights plan, commonly known as a pois...

Mercury Systems adopts anti-takeover tactic

29 December 2021

by Marc Selinger

Mercury Systems recently acquired Atlanta Micro, whose AM9017 Miniature Tuner can help detect a hostile electronic warfare system. (Mercury Systems' Atlanta Micro)

Mercury Systems' board of directors has approved a shareholder rights plan, commonly known as a poison pill, to prevent an unwelcome party from gaining control of the company, the US defence electronics supplier announced on 28 December.

Under the plan, if someone acquires 7.5% or more of Mercury's common shares without the board's approval, the company's other shareholders will have the right to buy preferred shares at twice the market value of the common shares. The proliferation of shares can make a hostile takeover too expensive.

Mercury said the rights plan, which has a one-year duration, is needed to reduce “the likelihood that any person or group gains control of the company without paying full and fair value”. Mercury believes its shares, which trade on the Nasdaq stock exchange, are undervalued.

“The Mercury board unanimously adopted the rights plan to protect the investment of shareholders during a period in which it believes shares of the company do not reflect the inherent value of the business or its long-term growth potential,” the company said.

Mercury Systems' board of directors has approved a shareholder rights plan, commonly known as a pois...

Mercury Systems adopts anti-takeover tactic

29 December 2021

by Marc Selinger

Mercury Systems recently acquired Atlanta Micro, whose AM9017 Miniature Tuner can help detect a hostile electronic warfare system. (Mercury Systems' Atlanta Micro)

Mercury Systems' board of directors has approved a shareholder rights plan, commonly known as a poison pill, to prevent an unwelcome party from gaining control of the company, the US defence electronics supplier announced on 28 December.

Under the plan, if someone acquires 7.5% or more of Mercury's common shares without the board's approval, the company's other shareholders will have the right to buy preferred shares at twice the market value of the common shares. The proliferation of shares can make a hostile takeover too expensive.

Mercury said the rights plan, which has a one-year duration, is needed to reduce “the likelihood that any person or group gains control of the company without paying full and fair value”. Mercury believes its shares, which trade on the Nasdaq stock exchange, are undervalued.

“The Mercury board unanimously adopted the rights plan to protect the investment of shareholders during a period in which it believes shares of the company do not reflect the inherent value of the business or its long-term growth potential,” the company said.

Mercury Systems' board of directors has approved a shareholder rights plan, commonly known as a pois...

Mercury Systems adopts anti-takeover tactic

29 December 2021

by Marc Selinger

Mercury Systems recently acquired Atlanta Micro, whose AM9017 Miniature Tuner can help detect a hostile electronic warfare system. (Mercury Systems' Atlanta Micro)

Mercury Systems' board of directors has approved a shareholder rights plan, commonly known as a poison pill, to prevent an unwelcome party from gaining control of the company, the US defence electronics supplier announced on 28 December.

Under the plan, if someone acquires 7.5% or more of Mercury's common shares without the board's approval, the company's other shareholders will have the right to buy preferred shares at twice the market value of the common shares. The proliferation of shares can make a hostile takeover too expensive.

Mercury said the rights plan, which has a one-year duration, is needed to reduce “the likelihood that any person or group gains control of the company without paying full and fair value”. Mercury believes its shares, which trade on the Nasdaq stock exchange, are undervalued.

“The Mercury board unanimously adopted the rights plan to protect the investment of shareholders during a period in which it believes shares of the company do not reflect the inherent value of the business or its long-term growth potential,” the company said.

Mercury Systems' board of directors has approved a shareholder rights plan, commonly known as a pois...

Mercury Systems adopts anti-takeover tactic

29 December 2021

by Marc Selinger

Mercury Systems recently acquired Atlanta Micro, whose AM9017 Miniature Tuner can help detect a hostile electronic warfare system. (Mercury Systems' Atlanta Micro)

Mercury Systems' board of directors has approved a shareholder rights plan, commonly known as a poison pill, to prevent an unwelcome party from gaining control of the company, the US defence electronics supplier announced on 28 December.

Under the plan, if someone acquires 7.5% or more of Mercury's common shares without the board's approval, the company's other shareholders will have the right to buy preferred shares at twice the market value of the common shares. The proliferation of shares can make a hostile takeover too expensive.

Mercury said the rights plan, which has a one-year duration, is needed to reduce “the likelihood that any person or group gains control of the company without paying full and fair value”. Mercury believes its shares, which trade on the Nasdaq stock exchange, are undervalued.

“The Mercury board unanimously adopted the rights plan to protect the investment of shareholders during a period in which it believes shares of the company do not reflect the inherent value of the business or its long-term growth potential,” the company said.

Mercury Systems' board of directors has approved a shareholder rights plan, commonly known as a pois...

Mercury Systems adopts anti-takeover tactic

29 December 2021

by Marc Selinger

Mercury Systems recently acquired Atlanta Micro, whose AM9017 Miniature Tuner can help detect a hostile electronic warfare system. (Mercury Systems' Atlanta Micro)

Mercury Systems' board of directors has approved a shareholder rights plan, commonly known as a poison pill, to prevent an unwelcome party from gaining control of the company, the US defence electronics supplier announced on 28 December.

Under the plan, if someone acquires 7.5% or more of Mercury's common shares without the board's approval, the company's other shareholders will have the right to buy preferred shares at twice the market value of the common shares. The proliferation of shares can make a hostile takeover too expensive.

Mercury said the rights plan, which has a one-year duration, is needed to reduce “the likelihood that any person or group gains control of the company without paying full and fair value”. Mercury believes its shares, which trade on the Nasdaq stock exchange, are undervalued.

“The Mercury board unanimously adopted the rights plan to protect the investment of shareholders during a period in which it believes shares of the company do not reflect the inherent value of the business or its long-term growth potential,” the company said.

Mercury Systems' board of directors has approved a shareholder rights plan, commonly known as a pois...

Mercury Systems adopts anti-takeover tactic

29 December 2021

by Marc Selinger

Mercury Systems recently acquired Atlanta Micro, whose AM9017 Miniature Tuner can help detect a hostile electronic warfare system. (Mercury Systems' Atlanta Micro)

Mercury Systems' board of directors has approved a shareholder rights plan, commonly known as a poison pill, to prevent an unwelcome party from gaining control of the company, the US defence electronics supplier announced on 28 December.

Under the plan, if someone acquires 7.5% or more of Mercury's common shares without the board's approval, the company's other shareholders will have the right to buy preferred shares at twice the market value of the common shares. The proliferation of shares can make a hostile takeover too expensive.

Mercury said the rights plan, which has a one-year duration, is needed to reduce “the likelihood that any person or group gains control of the company without paying full and fair value”. Mercury believes its shares, which trade on the Nasdaq stock exchange, are undervalued.

“The Mercury board unanimously adopted the rights plan to protect the investment of shareholders during a period in which it believes shares of the company do not reflect the inherent value of the business or its long-term growth potential,” the company said.

Mercury Systems' board of directors has approved a shareholder rights plan, commonly known as a pois...

News Janes | The latest defence and security news from Janes - the trusted source for defence intelligence

News Janes | The latest defence and security news from Janes - the trusted source for defence intelligence